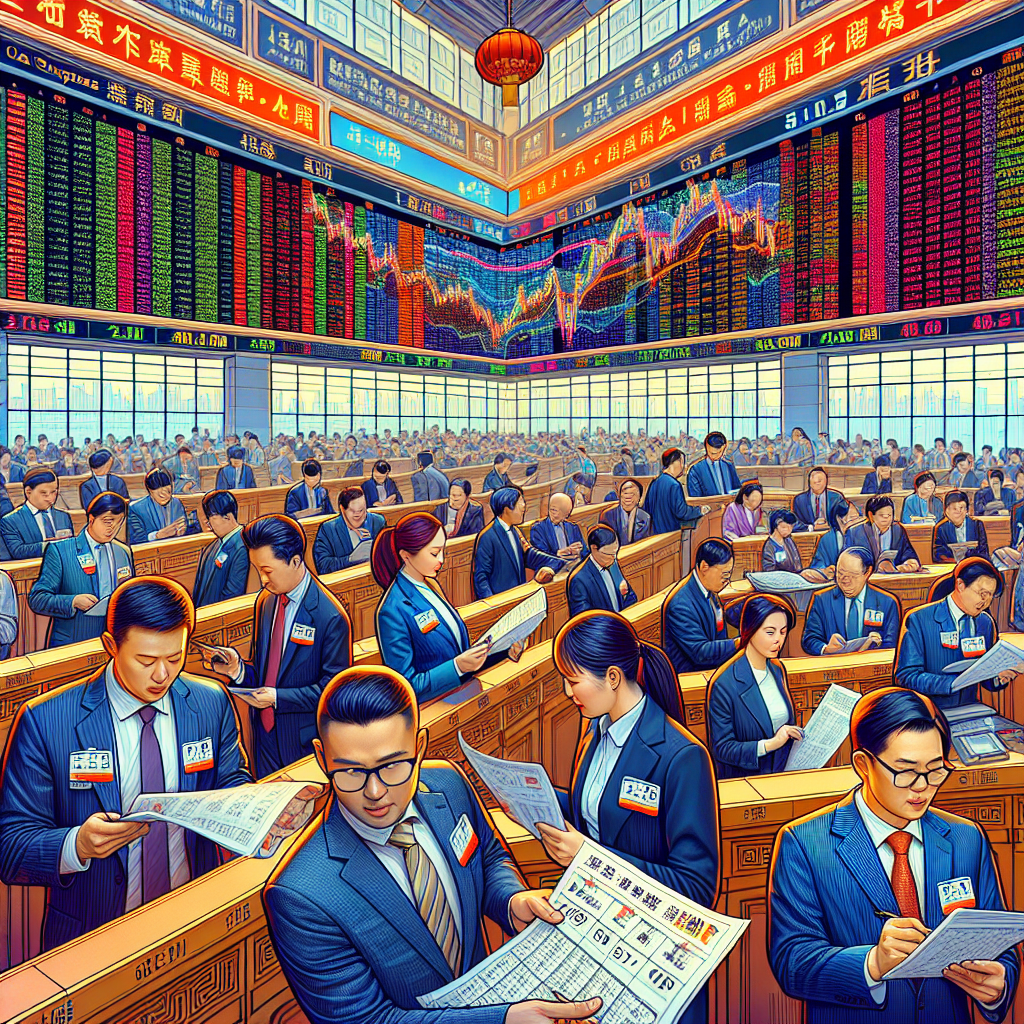

European Shares Climb Amid Easing Trade Tensions and Strong Earnings

European shares rose on Friday due to easing U.S.-China trade tensions and positive corporate earnings, with the STOXX 600 index climbing 0.3%. British retail sales unexpectedly increased, while Sanofi and Saab reported strong profits. U.S. consumer price data is awaited for further economic insights.

European shares made gains on Friday, driven by signs of reduced tensions in U.S.-China trade and a wave of strong corporate earnings, which uplifted investor confidence.

The STOXX 600 index rose 0.3% to 576.01 points by 0709 GMT, sustained by energy stocks. This follows a record close from the prior session after the U.S. imposed sanctions on key Russian suppliers, escalating the Ukraine conflict. Optimism further grew upon the confirmation of a meeting between U.S. President Donald Trump and his Chinese counterpart set for next week, ahead of a looming tariff deadline on Chinese imports.

Gains were also recorded in the European tech and financial sectors, both adding 0.8%, while the utilities index fell by 0.3%. In the UK, retail sales rose unexpectedly by 0.5% in September, marking a fourth straight month of growth. Investors are closely watching for upcoming U.S. consumer price data, influential economic indicators that precede next week's Federal Reserve policy meeting. Notably, Sanofi's shares jumped 3.3% following a third-quarter profit beat, while Saab's stock surged nearly 6% after lifting its sales outlook, supported by elevated military spending.

ALSO READ

-

Global Markets Soar Amid Cooling Trade Tensions and Tech Gains

-

Stocks Surge as U.S.-China Trade Tensions Ease

-

European Shares Decline Amid Focus Shift to Corporate Earnings

-

Global Markets Rally Amid Eased Trade Tensions and Anticipated Central Bank Moves

-

Market Moves Amid Corporate Earnings and AI Speculations