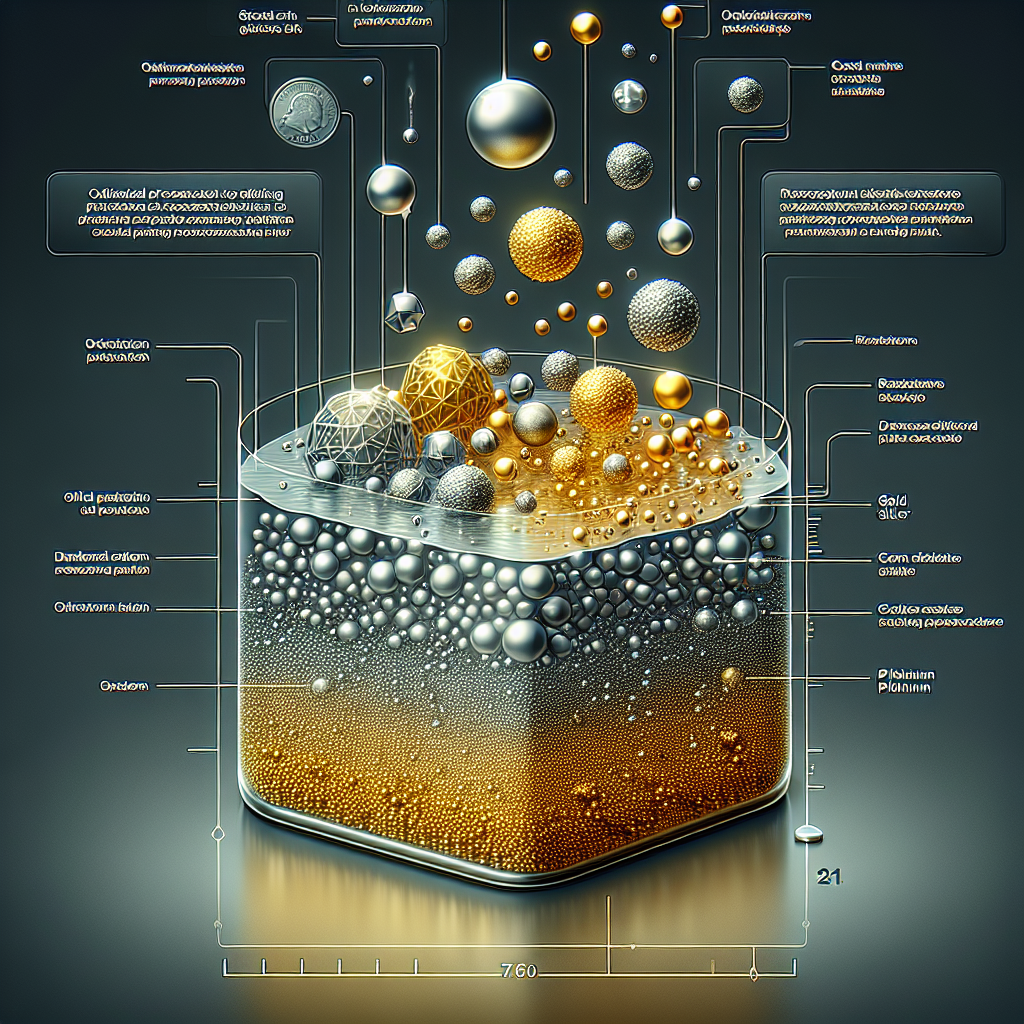

Gold and Silver Struggle Amid Global Market Turmoil

Gold and silver partially recovered early losses but faced a second consecutive week of decline due to a tech equity rout and a stronger U.S. dollar. Despite a brief mid-week rebound, metals were pummeled alongside cryptocurrencies by market volatility, with silver experiencing significant losses.

Gold and silver managed to recoup some early losses on Friday, yet are poised for a second successive week of decline. This downturn comes amidst a global tech equity selloff and a strengthening U.S. dollar, which erased gains from an earlier rebound within the week.

Spot gold increased by 0.4% to $4,790.80 per ounce, although it remains down 1.4% weekly. April U.S. gold futures also fell by 1.7% to $4,806.50 per ounce. Concurrently, spot silver stabilized at $71.32 per ounce, following a sharp 19.1% drop in the prior session. Silver's turbulent week saw it fall as low as $65, marking its steepest weekly decline since 2011.

Market experts highlight a dampened risk appetite, affecting stocks and cryptocurrencies, while silver continues its downtrend. As global equities experience further losses, JP Morgan suggests that silver's valuation could lead to outsized corrections in risk-off scenarios. Meanwhile, the U.S. dollar’s rally adds additional pressure on dollar-priced assets.

ALSO READ

-

Hong Kong and Chinese Markets Struggle Amid Global Tech Selloff and Silver Slump

-

Gold Holds Steady Amidst Market Turmoil; Silver Faces Intense Volatility

-

UBS SDIC Silver Futures Fund Trading Suspended Amid Silver Slump

-

Silver's Unexpected Dive Below $65

-

Global Markets Turbulence: AI, Silver, and Oil in Focus