TSMC's Profit Surge Amid AI Boom and Tariff Challenges

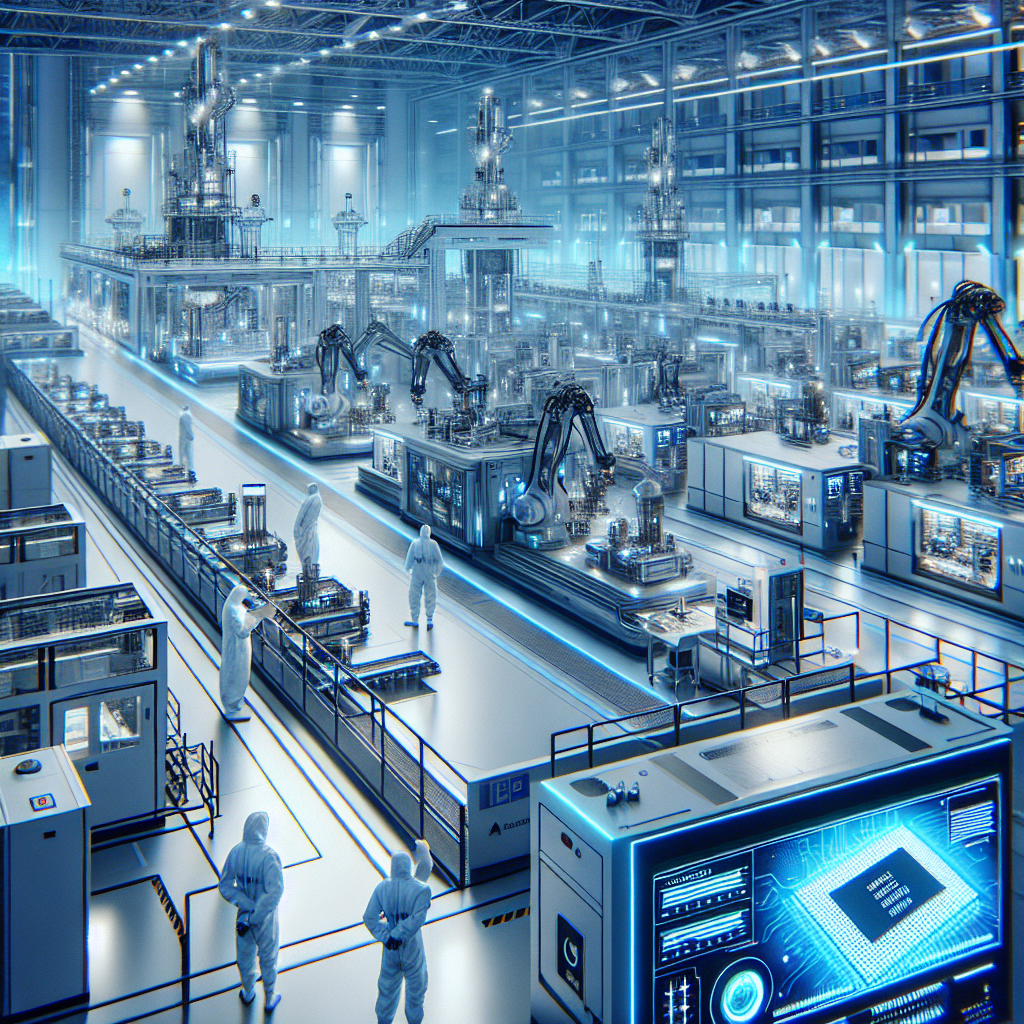

TSMC, the world's leading AI chip manufacturer, is forecast to achieve a 28% profit increase in the third quarter, driven by escalating AI infrastructure demand. Despite possible impacts from U.S. tariffs, the company anticipates record earnings and continues to invest significantly in U.S. factories.

Taiwan Semiconductor Manufacturing Co. (TSMC), the preeminent producer of cutting-edge AI chips, is on track for a remarkable 28% profit increase in the third quarter, fueled by relentless demand for AI infrastructure. This surge comes despite potential challenges from U.S. tariffs, which could influence future prospects.

SmartEstimate, compiled from 20 analysts, projects TSMC to report a net profit of T$415.4 billion ($13.55 billion) for the quarter ending September 30. TSMC has already indicated a market-surpassing 30% rise in third-quarter revenue, foreshadowing what would be the company's highest-ever quarterly net income.

While trade disputes add an element of uncertainty, the ongoing growth of AI infrastructure remains a focal point for cloud-service providers and manufacturers. In response, TSMC is investing $165 billion in U.S. factory development, reinforcing its position against tariff concerns, bolstered by a 30% rise in its share values this year.

ALSO READ

-

TSMC is accelerating its Arizona expansion plans; keep investing in Taiwan

-

US STOCKS-Wall St mixed; chipmakers rise after TSMC's results support AI optimism

-

US STOCKS-Wall St advances after TSMC's results support renewed AI optimism

-

US STOCKS SNAPSHOT-Wall St rises with TSMC results supporting renewed AI optimism

-

US STOCKS-Wall St set for higher open after TSMC's results support renewed AI optimism