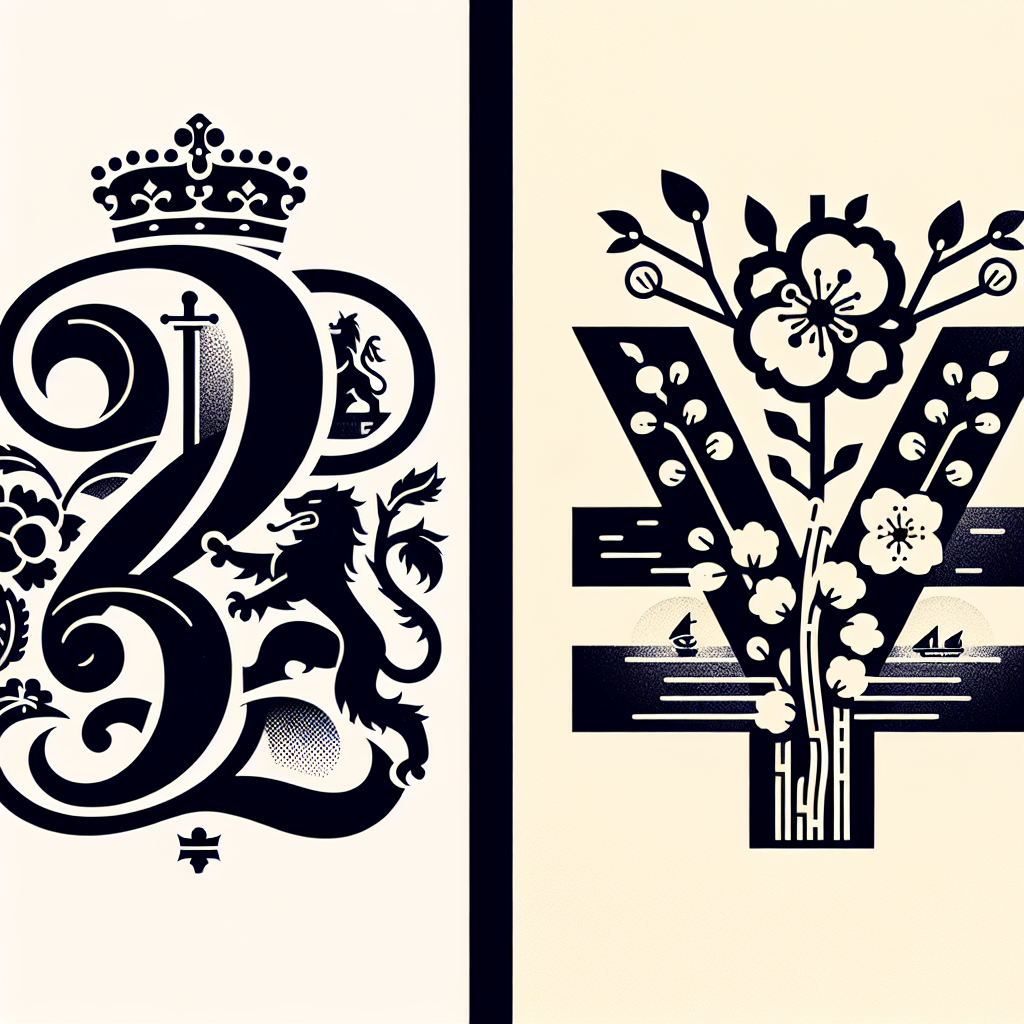

Yen Rallies as Takaichi's Election Win Sparks Economic Optimism

The yen strengthened after Japanese Prime Minister Sanae Takaichi's electoral win, reversing recent losses amid fiscal stimulus expectations. While initially weak, the currency rallied alongside the U.S. dollar's decline. Analysts predict currency volatility due to Takaichi's pro-growth policies, impacting Japan's fiscal dynamics and potential Bank of Japan rate hikes.

The Japanese yen experienced a robust rally on Monday, buoyed by Prime Minister Sanae Takaichi's election victory. This political shift ignited hopes for fiscal stimulus, reversing a six-day losing streak for the currency. As traders anticipate stock market gains, the yen appreciated, while the U.S. dollar faced pressure against key global currencies.

Initially, the yen exhibited weakness post-election, reaching its lowest in two weeks. However, sentiment shifted, leading to a 0.5% decline in the dollar-yen exchange at 156.36. Other currencies, like the Swiss franc and euro, saw the yen bounce back from historic lows, reflecting renewed confidence in Japanese fiscal policy.

Despite currency strategist warnings of potential intervention risks, Takaichi's pro-growth agenda seems to galvanize investor sentiment. Analysts suggest an expansionary fiscal policy could introduce inflationary pressures, prompting possible interest rate adjustments from the Bank of Japan. As markets react, currency dynamics remain a focal point for global economics.

ALSO READ

-

Uncertainty Looms Despite Takaichi's Triumph

-

Japan's Election Triumph: Takaichi Thanks Modi, Highlights Strategic Indo-Pacific Partnership

-

Global Equities Surge Amid US Chip Stock Rebound and Japanese Election Victory

-

Sanae Takaichi's Electoral Triumph Amidst Diplomatic Tension

-

Takaichi's Bold Moves: Japan's Rightward Shift Under New Leadership