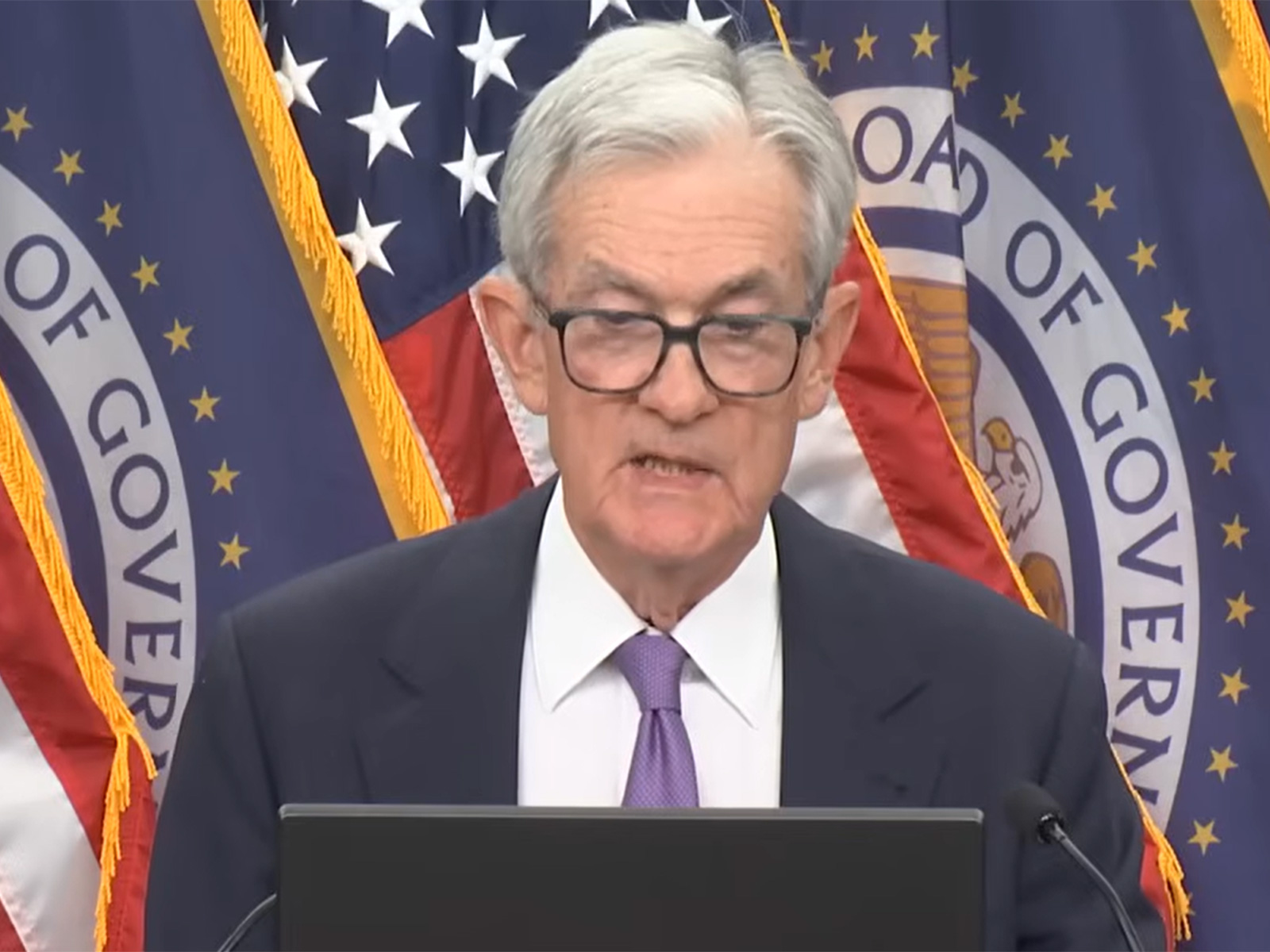

Federal Reserve Takes Decisive Step with Interest Rate Cut Amid Economic Shifts

The Federal Reserve has lowered the federal funds rate by 0.25%, amidst slowing job growth and rising unemployment. The Fed aims to balance employment and price stability as inflation remains elevated. Future policy changes will hinge on new economic data, with potential adjustments ready if new risks emerge.

- Country:

- India

In a significant monetary policy move, the Federal Reserve announced a quarter-percentage point cut in the federal funds rate, setting the target range between 3.75% and 4%. This decision reflects growing economic concerns and aims to preemptively address signs of a cooling U.S. economy.

A Wednesday press release detailed the Fed's reasoning, highlighting a slowdown in job growth and a subtle rise in unemployment, despite remaining low through August. While inflation had decreased earlier this year, it has recently ticked up, challenging the Federal Open Market Committee's dual mandate of maintaining maximum employment and price stability.

The Committee underscored its commitment to monitor incoming economic data, pledging readiness to adjust policies if needed to counter emerging threats impeding its goals. The Fed also plans to conclude its reduction of aggregate securities holdings by December 1, highlighting ongoing uncertainty in the economic outlook.